The YMCA BC Foundation promotes, supports and funds the YMCA to build healthier communities for this generation and those that follow.

The Foundation is a separate registered charity that supports the social life-enhancing programs and initiatives of YMCA BC. This support is made possible thanks to the generosity of individuals who have made a legacy gift to the YMCA.

Leaving a legacy through the YMCA BC Foundation is about building sustainable futures to help generations of children and families thrive, promote healthy living and creating belonging and connection. Your legacy makes sure that the YMCA is supported, and gives you an opportunity to make a lasting difference in the lives of others—in your lifetime and beyond. The YMCA BC Foundation's impact is great—thanks to donations like yours.

In Memoriam: Angela Spanjers

We regret to inform our Y Family of the recent passing of Angela Spanjers, past YMCA BC Foundation Board Chair. Angela passed away Feb. 22 at the age of 43 following a courageous battle with cancer. Angela first joined the Foundation Board in 2015 and served until her 2024 resignation due to health concerns. Under her leadership as Chair, the YMCA of Greater Vancouver Foundation advanced its mandate of investment and legacy giving, as her background in estate planning was a valuable resource. Angela did not let her health take away from her commitment and passion for the YMCA. Her Y story began in a Youth Leadership program, and as a mother with two children, she has passed on her passion for the Y to them. In her last few months, Angela had amazing family support and palliative care that enabled her to enjoy time with loved ones and face her illness with a positive outlook.

In honour of her memory, the YBC Foundation has approved the establishment of the Angela Spanjers Youth Fund, which will support YMCA BC’s youth programing with focus on female leadership. Angela’s husband, her two children and extended family have expressed their gratitude to the YMCA.

The family invites you to give to the Y in Angela's memory. Donate online at: https://www.gv.ymca.ca/?form=donatenow. Click Designate to and select Angela Spanjers Youth Fund.

The family will be notified of your generous gift in Angela's memory.

Ways to Give to the Foundation

There are many ways to leave a legacy through the YMCA BC Foundation—we are here to help you meet your philanthropic goals. You can set up a named fund, contribute to an existing one, or make a legacy gift in various ways. Careful planning can mean more for family and charity, with fewer taxes payable from your estate. With all legacy giving, we strongly recommend that you speak with your financial advisor and your family to ensure you are choosing the legacy option that is right for you.

The YMCA BC Foundation is a registered Canadian charity and issues tax receipts for all donations.

Planning your Gift to the Foundation

You can leave a transformational legacy gift in a variety of ways. If you have left a gift in your will, let us know so we can include you as a Heritage Club Member.

Leave a Gift in your Will

Consider leaving a gift in your will (bequest) to the YMCA BC Foundation. An official receipt for income tax purposes will be sent to you when the bequest is received. Bequests can be a specific dollar amount or a residual gift (the entire residue or portion of your estate). Most lawyers require the name of the charity and charity number for your will:

YMCA BC Foundation, Charitable Registration Number - 803 976 471 RR0001.

If you require further wording, please do not hesitate to contact us at giving@bc.ymca.ca or 604.622.4954.

Named Designated Funds

Establish a named endowment in honour of a loved one or your family with a gift of $25,000 or greater. Both current and deferred gifts are possible. Named funds enable friends and family members to make tribute gifts, in memoriam gifts, and special occasion gifts (birthdays and anniversaries) to celebrate your wishes for generations.

Speak to your financial expert to discuss establishing a fund via RRSP/RRIF/TFSA and/or Life Insurance contributions.

Publicly Traded Securities

Gifts of appreciated publicly traded securities are a powerful way to support your favourite YMCA programs and help vulnerable individuals and families in your community. Your gift of securities entitles you to a donation receipt for the full market value (resale) of your contribution. This will result in a non-refundable tax credit that will reduce your income taxes—you can use it in the year of your gift or carry it forward for up to five additional years.

You pay no capital gains tax on the appreciated value of your securities. Donating securities directly to YMCA BC or YMCA BC Foundation avoids the tax on capital gains, maximizes the return on your investment and protects the tax credits for use against other taxable income.

For more information, or to notify us of your gift to ensure it's designated according to your wishes, please contact us at giving@bc.ymca.ca.

Ellen Bell YMCA Memorial Scholarship

The YMCA BC Foundation presents an annual scholarship to a female post-secondary student pursuing a career in marketing or advertising in honour of the late Ellen Bell, a committed YMCA volunteer who strived for the betterment of her community.

"I was wanting to pursue a BBA but it was something I had to think, financially, if it made sense. I look forward to being able to access that now because of this scholarship."

—Tamiya Kabatoff, 2022 Ellen Bell YMCA Memorial Scholarship recipient

Learn more about the Scholarship

Heritage Club

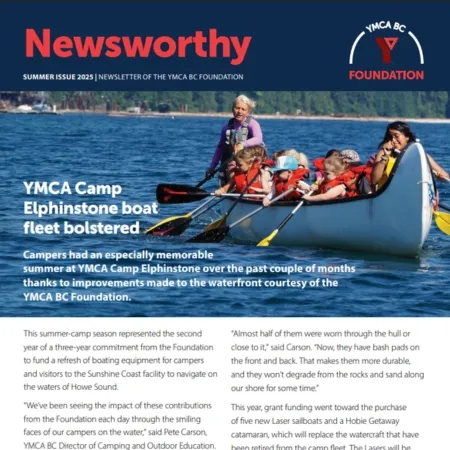

Newsworthy

Members of the Heritage Club receive a copy of Newsworthy multiple times per year. This newsletter of the YMCA BC Foundation includes feature stories on how your gifts are making a difference.

Please click below to read our most recent copy of Newsworthy. This digital edition is an accessible copy compatible with screen readers.

Contact Us:

YMCA BC Foundation

10 - 620 Royal Avenue

New Westminster, BC, V3M 1J2

giving@bc.ymca.ca

Charitable Registration Number: 803 976 471 RR0001